Will the Dems Raise Taxes?

Michael Mandel at Business Week writes:

[AF]

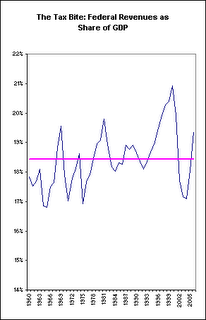

Probably not, if this chart is any guide.

The thin blue line tracks federal revenues as a share of GDP (through the second quarter of 2006). The purple horizontal line is the average revenue share since 1960.

Generally speaking, we are more likely to get tax cuts when the revenue share is well above the long-term average, and tax increases when the revenue share is below the long term average of 18.4%. So the tax revenue share had peaks in 1981 (19.8%) and 2000 (20.9%), right around the time of the 1981 Reagan cut and the 2001 Bush cut. And the tax revenue share bottomed in 1992 (18.1%), right before the Clinton tax increase. (all these numbers are based on BEA data).

I think of this in political terms. When Americans are paying a lot of money in taxes, they are more receptive to a tax cut. And if they are paying relatively less money, they are less opposed to a tax increase.

Of course, this link does not explain the second Bush tax cut, in 2003, when the revenue share of 17.2% was already well below the long-term average.

But still, with the federal revenue share at 19.4% according to the BEA, that's well above the long-term average. And that suggests that Democrats will find a fair bit of "push-back" if they try to raise taxes.

0 Comments:

Post a Comment

<< Home