What Does Iraq Cost? Even More Than You Think. - washingtonpost.com

What Does Iraq Cost? Even More Than You Think. - washingtonpost.com: "You may recall that you got rid of your loyal White House economic adviser Lawrence B. Lindsey back in 2002 after, among other sins, he claimed that a war in Iraq might cost as much as $200 billion. At the time, White House staffers sneered that Lindsey was being alarmist. Hardly. One commonly cited estimate of Iraq's cost, based on an August analysis by the nonpartisan Congressional Budget Office, is $1 trillion, and that's probably on the low side. A report released last week by the Democratic staff of Congress's Joint Economic Committee put the war's 2002-08 tab at $1.3 trillion.

But all these figures don't quite get at Iraq's real cost. Indeed, we usually don't even frame the question the right way. We'd do better to recognize what we've lost, rather than focusing only on what we've paid.

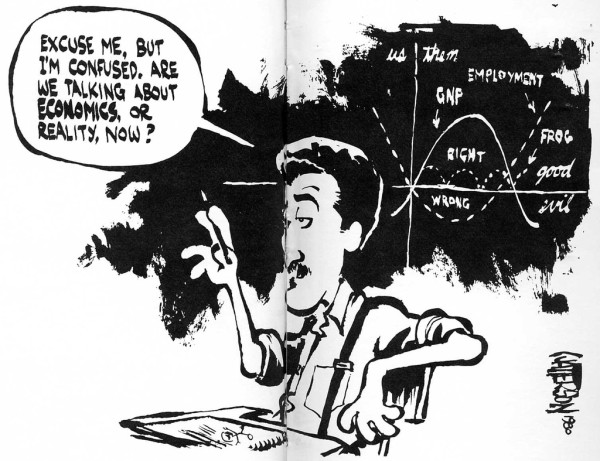

We often think of cost simply in terms of dollars spent, but the real cost of a choice -- what economists call its 'opportunity cost' -- consists of the forgone alternatives, of the things we could have had instead. For instance, the cost of seeing a movie is not just the dollars you plunked down for the ticket, but also the subtler cost of missing a dinner at home or a cocktail party at work. This idea sounds simple, but if applied consistently, it requires us to rethink and, yes, raise the costs of the Iraq war."

(Via MR.)